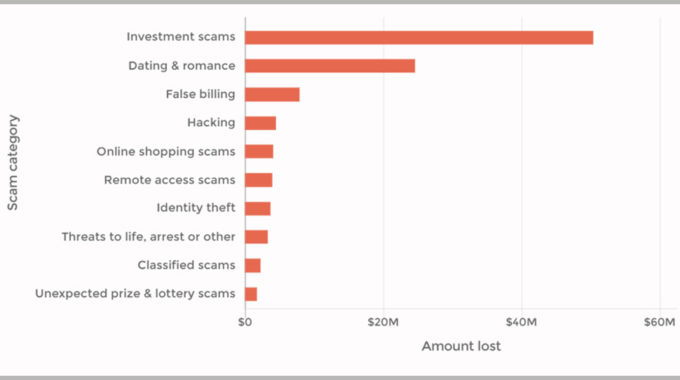

‘Investment scams’ ranked number 1 as top scam in Australia!

According to Scamwatch, ‘investment’ scams continue to dominate as the top scam in Australia this year by amount of money lost.

Of the 144,996 cases of scams reported as at 22/11/19, 11.3% of these reported financial losses.

The total money lost by consumers and business in investment scams has now nudged past a whopping $50.5 million – a terrifying statistic and one can only imagine the emotional and financial pain and suffering this has caused for those who have been affected and my heart goes out to these people. And as we head towards the festive season, consumers need to be even more cautious and diligent.

With the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry unveiling wave after wave of shocking behaviour, misconduct, corruption and fraud across the industry at many levels, it’s no surprise that consumer confidence and trust in the sector is at a record low.

‘Obey the law, do not mislead or deceive, be fair, provide services that are fit for purpose, deliver services with reasonable care and skill, when acting for another, act in the best interests of that other’ – these were six key points made by Commissioner Hayne. It will be interesting to see what changes unfold in the industry both by the financial institutions themselves, and the regulatory bodies!

No doubt it will take a long time for trust to be rebuilt, and in the meantime it’s an extremely difficult time for the ‘good apples’ who choose to continue to work in the industry. I have personally had several friends in Perth who were mortgage brokers and investment bankers who have left the industry and to be honest I don’t blame them. It’s a very difficult situation they have found themselves in, especially as it had been their main career for many years and they had invested themselves emotionally, financially and with years of education and training.

It will be a very long, bumpy road and only those in the industry who truly are transparent in their service offerings and dealings, communicate with honesty and openness and with a conscience, and willing to be patient for the very long term, will, I expect, very slowly begin to regain some of the trust. Only time will tell, or maybe not?

Sharon Box

Founder, Owner and Lead Behavioural Investigator – Mind Hush Group.

Source: ACCC

Scamwatch is run by the ACCC (Australian Competition and Consumer Commission). The government agency provides information to consumers and businesses on how to identify and report scams, as well as ways to minimise and avoid them. Their data is based on reports provided to them online and by telephone. It is unknown how many other cases of scams remain unreported.